Financial information - a necessary ingredient to invest like Buffett

I’ve spent years researching Warren Buffett. And one thing I’ve learned is that having a reliable source of accurate financial information is essential when researching a company.

It is all very well knowing what information Warren Buffett and value investors look for when deciding to invest, but where do you get that information?

Buffett and the big boys have the staff, resources and money to do this research but ordinary investors like us don’t. And one would imagine that if Buffett sought clarification of any balance sheet issues, he could just enquire from the company he is looking at. It is hard to believe that any company exec would not take a call from the Sage of Omaha.

Fortunately, I’ve discovered a wonderful website that offers all the information you could need for free. And when I say free, I mean it:

- No tricks

- No “trial periods”

- No credit card registrations

- Just a simple signup that takes less than one minute to complete.

Getting the information for nothing

The crucial information a value investor like Warren Buffett uses is obtained from company balance sheets. Most companies publish their recent accounts on their website, but we need more than the most recent one or two to investigate a company. However just about every country with a stock exchange requires listed companies to file their accounts with some regulatory body. This is one place where you can find historical balance sheets, but this can be time consuming and often requires personal attendance. Sometimes they charge a fee.

So how can you get that information easily, from your home, and for free?

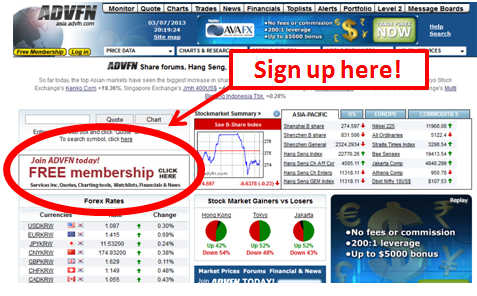

What we do is subscribe to ADVFN. ADVFN is a financial information service. They offer a free subscription service and this allows you to get details of the balance sheets of a company over a period of years. You can go back 1 year, 2 years or as many as you like. We go for 10 years which is the period that we like to use. The information comes in an easy to understand column form.

There are all sorts of details provided by ADVFN extracted from company balance sheets and which cost you nothing. The ones that we find most relevant are these:

From the Balance Sheet

- Total revenue and adjustments

- Cost of sales

- Gross and net margins

- Gross and net profits

- EBIT and EBITDA

- Depreciation, Capex and R and D

- Earnings per share

- Return on equity, return on capital, return on assets

- Owner’s equity

- Cash flow

- Book value per share

- Current and fixed assets

- Current and long term debt (It even works out the current ratio for you)

- Inventories (in some detail)

With this information, we can apply the principles that investors like Buffett follow when looking at possible investments

Other features and information available from ADVFN

- Details of sales

- Industry comparisons

- Market capitalization

- Price data

- News and forums

There is almost certainly other information which you will find useful. And it is not limited to the New York Stock Exchange. You can get information on companies listed on the NASDAQ and on the stock exchanges of other countries.

ADVFN are also famous for their investor forums, where you can talk with and learn from other investors.

How to register for ADVFN

The ADVFN home page can be a bit confusing at first because of all the information on offer. Don’t worry - you’ll soon get used to it. Here’s how to sign up:

Give it a try

ADVFN also has a paid subscription but at this stage we have not subscribed because we can get everything that we need from the free service. Give it a try – it will cost you nothing. And if you don’t like it, just unsubscribe.