The price of gold has has risen sharply in recent years and it is seen as a good hedge against inflation, particularly in the non-Western countries. According to the World Gold Council, the price has just about doubled in the last five years, going from $800 an ounce in 2008 to $1670 or so today. (In 2003, the price was half the 2008 price).

This is a very good return, better than the market and better than Buffett’s own Berkshire Hathaway during that period. So why is Buffett not into gold? He said why in his 2011 letter to shareholders in which he divided investments into three classes; currency denominated investments which are at the risk of inflation, government decisions and speculation; investments that depend on the intention of others (where you buy an asset in the hope or expectation that someone else will pay a higher price); and investments in productive assets (the preferable investment).

According to Buffett, gold comes within the second class (speculative investments) and although it does have a productive quality (use in manufacture, for example), it still carries the risk that the expectation that others will bid the price up will not be fulfilled. And its industrial use is limited by supply and demand and is secondary to its use as a holding or speculative asset.

True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

Buffett acknowledged the dramatic rise in the price of gold over the past ten years but puts this down to both fear and greed and believes that it has been self-generated rather than meaningful in investment terms. He thinks that it is somewhat of a bubble.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

As bandwagon investors join any party, they create their own truth – for a while.

Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the ‘proof’ delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop. And then the old proverb is confirmed once again: ‘What the wise man does in the beginning, the fool does in the end’.

Buffett argues his case against gold by looking at the total value of the world’s gold and seeing what would happen if you put that amount into productive assets such as farming land and quality businesses. Whereas gold produces no income and the gold owner has to rely upon the opinion of others for an increase in its value, farms produce crops which can be sold at a profit and quality businesses sell things which produce dividends. Over time, Buffett says, the total return from the productive assets must exceed any increase in the value of the gold.

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

We like the parable but you need to realize that Buffett is talking in the long term and not the short term. He is not saying that people will not make short term gains in speculative assets like gold; he is saying that, as a long term investment, quality productive assets carry less risk and will return better gains.

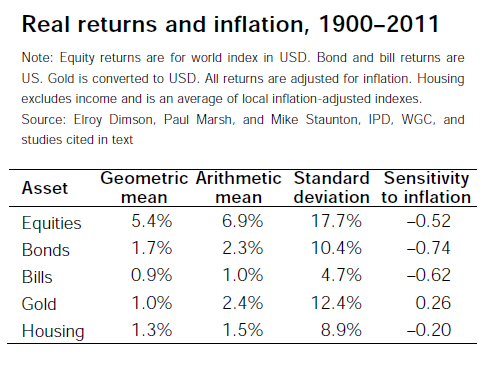

Charlie Munger has gone even further than Buffett in scoffing at investing in gold, saying in response to a question as to whether holding gold was a hedge against inflation, that gold investing makes no sense. This would seem to be statistically correct. In 2012, Credit-Suisse looked at how various classes of assets performed globally against inflation over a protracted period. The study found that in between 1900 and 2011 investment in equities outperformed bonds, housing and gold (equities 5.4 per cent against gold 1 per cent in real terms).